近日,汉坤律师事务所发布《汉坤2020年度VC/PE项目数据分析报告》(以下简称“报告”),并在其网站顺利上线,网站链接:

https://www.hankunlaw.com/newsAndInsights/lawDetail.html?id=2c91af0879699b75017a5ba5d3740bae。

Recently, Han Kun Law Offices issues Han Kun 2020 VC/PE Deal Data Analysis Report(the “Report”). The online version of the Report is available at the Firm’s website.

报告对2020年度汉坤参与的超过500个VC/PE交易项目进行了数据整理和分析,并结合对过去四年收集的超过2,000个VC/PE项目的横向对比,从一个侧面展现了2020年度风险和私募股权投资项目的特点和这类项目在我国的发展趋势。

The Report uses data collected from over 2000 venture capital and private equity transactions that Han Kun worked on in the past four years (including over 500 in 2020 alone) to recap common features of VC/PE transactions in China and help forecast how they might evolve in the future through the lens of practicing lawyers.

Part I

报告*部分总结了2020年度汉坤参与的VC/PE交易呈现的几个趋势和特点:

Part I of the Report is an executive summary which highlights trends revealed by the VC/PE transactions in 2020, as follows:

财务投资项目的比例略微升高。

Transactions driven by financial returns saw an uptick.

采用境内架构采用JV模式的比例有所增长;境外架构中不采用VIE模式的比例也有提升。

Onshore transactions with built-in JV structures increased.And so did offshore transactions with non-VIE structure.

被投公司主要业务运营地,分别是北京、上海、深圳、杭州和广州。

Beijing, Shanghai, Shenzhen, Hangzhou, and Guangzhoucontinued to be favored by investee companies to base their principal operations.

排名前五的被投资行业分别是生物医疗、智能硬件(人工智能、AR等)、企业服务、餐饮服务和电子商务。

op-five VC/PE investment destinations were biomedicine, smart hardware, corporate services, catering services, and e-commerce.

Part II

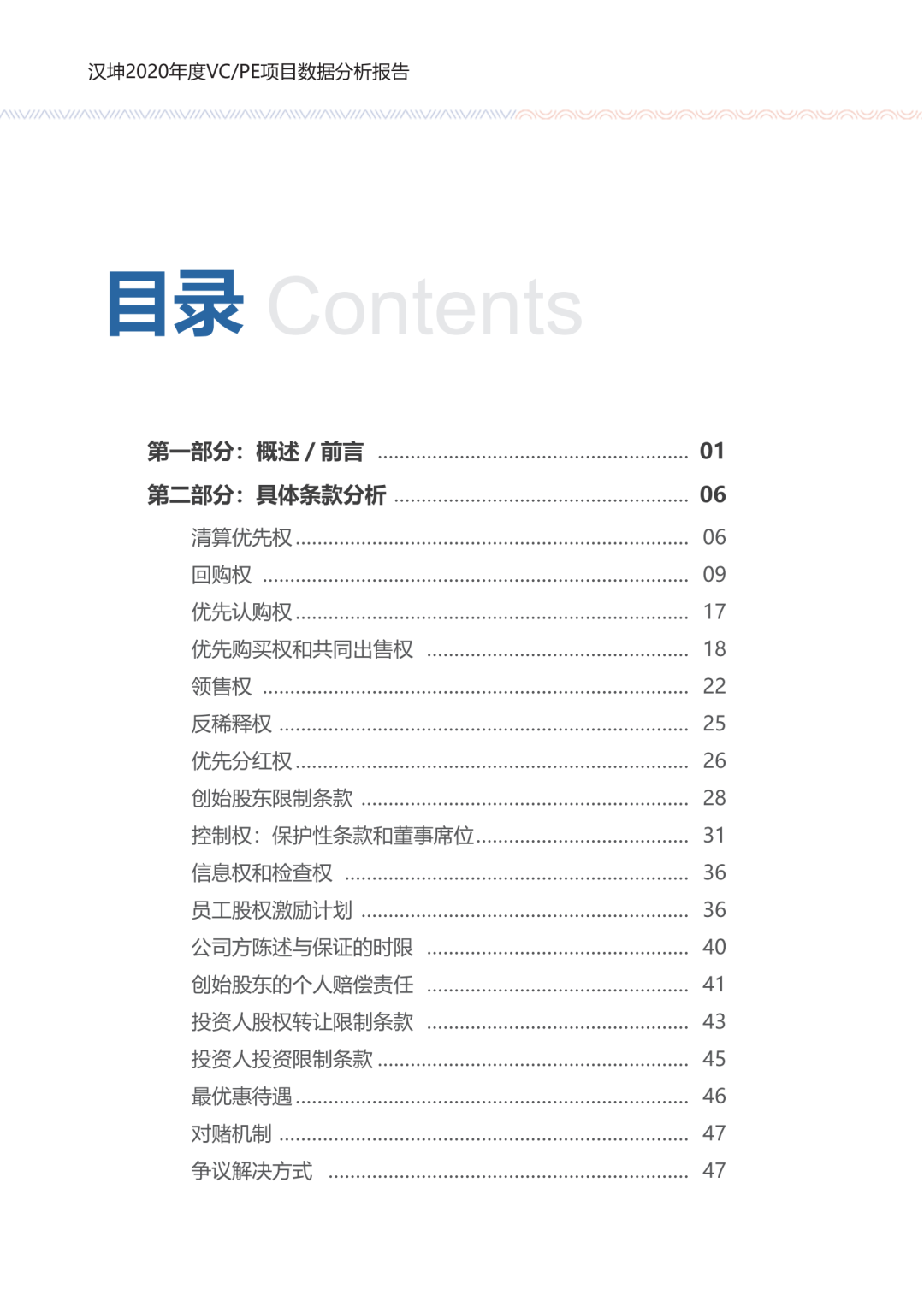

报告第二部分是重点,它对VC/PE交易中多个关键法律条款进行了梳理和对比分析,归纳总结其变化趋势。这些条款包括:清算优先权、回购权、优先认购权、优先购买权和共同出售权、领售权、反稀释权、优先分红权、创始股东股权限制条款、保护性条款和董事席位、信息权和检查权、员工股权激励计划、公司方陈述与保证时限、创始股东的个人赔偿责任、投资人股权转让限制条款、投资人投资限制条款、*惠待遇、对赌机制及争议解决方式等。

Part II is the central part of the Report. It documents the development of certain key provisions commonly used in VC/PE transactions and tracks changes in their applications over the years. These provisions include liquidation preference, redemption right, preemptive rights, right of first refusal and co-sale right, drag-along right, anti-dilution right, dividend preference, restrictions on founders, protective provision and board composition, information right and inspection right, employee equity incentive plan, survival period of representations and warranties, founders’ personal indemnification liability, investor’s share transfer restrictions, investors’ investment restrictions, most-favored nation, valuation adjustment mechanism, dispute resolution.

这是一份年度报告。今年是报告的第五个年头。汉坤律师事务所希望这份报告能够和往常一样,对中国VC/PE市场的发展和变化提供一些有用的参考和借鉴。

The Report, which is published annually, is the fifth issue of its kind. It is the hope of Han Kun Law Offices that this Report, like its predecessors, will offer useful references to the development of China’s VC/PE market.

关于汉坤律师事务所

About Han Kun Law Offices

汉坤律师事务所是中国*的综合性律师事务所,专注于国内、国际间复杂的商业交易和争议的解决。在具体业务领域里,汉坤尤其以私募股权、兼并和收购、境内外证券发行与上市、投资基金/资产管理、反垄断/竞争法、银行金融、飞机融资、外商直接投资、公司合规、私人财富管理、知识产权、争议解决等板块的法律服务著称,连年被业界评为亚太区领军中国律所。

Han Kun is a full-service law firm in China and a leader in many important practice areas including private equity, mergers and acquisitions, international and domestic capital markets, investment funds/asset management, antitrust/competition, banking and finance, aviation finance, foreign direct investment, compliance, private client/wealth management, intellectual property and dispute resolution. Han Kun has been consistently recognized by the industry as a leading Chinese law firm in the Asia-Pacific region.

欲了解更多详情,请访问汉坤律师事务所官网:

https://www.hankunlaw.com/index.html

For more details, please visit the Han Kun Law Offices official website:

https://www.hankunlaw.com/index.html

汉坤律师事务所官方微信账号:汉坤律师事务所(WeChat ID: hankunlaw)

【本文由投资界合作伙伴微信公众号:清科研究授权发布,本平台仅提供信息存储服务。】如有任何疑问,请联系(editor@zero2ipo.com.cn)投资界处理。